Kuflink’s Environmental, Social and Governance

Environmental

Our environmental indicator relates to areas of our performance that have an environmental impact.

| ESG | ESG Impact | What we’re doing | |

|---|---|---|---|

| 1 | Reduce paper | Low | We have made tremendous leaps into moving into the cloud and minimising the need for paper in the office. Being a FinTech business we feel it is achievable to go fully paperless within the year. |

| 2 | Cycle-to-work Programs | Medium | We have set this offering up for our employees and hope to see people take this up soon. |

| 3 | Energy Efficient Offices | High | Our current office premises has an EPC rating of C. Within the next two-year we will be moving to new purpose-built energy-efficient premises. We have let all staff know they can apply through the Kent website for solar panels to help with their own energy efficiency at home |

| 4 | Development Loans - Element of Green - solar, car chargers | High | We work with many different property developers who work on anything from refurbishments to brand new housing estates, we will shortly be publishing how green some of these are, watch this space! |

| 5 | Electric Charger at the Office and BCP Address | High | We have Electric charging points both at the Head Office premises and also at our Business Continuity Site (from August 2021). |

| 6 | We expect to achieve Net Zero carbon emissions by 2030 | High | Migrate remaining systems to the Cloud, fund green innovation, fund green innovation in property developments, give clients better information when they make decisions, Build carbon-free head office and use AI technologies to enhance our algorithms and effect efficiencies. |

EPC for Kuflink’s Head Quarters

| Total Floor Area | EPC Rating | Link | |

|---|---|---|---|

| 1 | 102 Square Metres | C (Target B by 2030) | Energy performance certificate EPC Find an energy certificate GOV.UK |

| 1 | 403 Square Metres | C (Target B by 2030) | Energy performance certificate EPC Find an energy certificate GOV.UK |

Social

Our social indicator relates to areas of our performance in respect of our management of relationships with employees, suppliers, customers and the communities within which we operate.

| ESG | ESG Impact | What we’re doing | |

|---|---|---|---|

| 1 | Vulnerable customers | Medium | We are continually working to ensure we incorporate vulnerability considerations into the way we do business be that by tailoring our communications with people, making our products easy to understand and having dedicated people for our customers to talk to. |

| 2 | Employee training | Low | We train all our staff to ensure they can deliver the best possible service to our customers, we equip them with the knowledge they need to effectively carry out their roles and we ensure they undertake all the relevant training in order for us to remain compliant in all we do. |

| 3 | Develop Socially responsible products | High | We work with many different property developers who work on anything from refurbishments to brand new housing estates, we will shortly be publishing how green some of these are, watch this space! |

| 4 | Health and wellbeing of colleagues | Medium | It’s no secret that a healthy workforce is a more productive workforce, we ensure we regularly ask our people what they want from the business and how we can improve. We want to ensure they are happy in their environment and we want people to want to be here with us. |

| 5 | Financial Wellbeing of colleagues | Medium | We encourage people to undertake qualifications that will help them in their role and we fund this to help them and us. We also do financial educational training. |

| 6 | Adaptation to ways of working due to the pandemic | Medium | We have adopted a flexible working environment as we appreciate that no two people are the same. We let our team work from home one day a week if they choose to and they can change their working hours if they need to. |

| 7 | Access to skills | Medium | We have a lot of experts in their fields within the business who are able to offer training and we have regular training sessions for all compliance topics. |

| 8 | Charity and Community Support | Medium | 1. We currently sponsor Kuflink Stadium – Ebbsfleet United Football club and have done for many years now |

| 9 | Modern Slavery Statement | Medium | Voluntary slavery and human trafficking statement |

| 10 | High | ESG Policy Statement |

|

| 11 | Code Of Ethics (Adopted 30/01/2022) |

Medium | 1. You must comply with this Code and all relevant laws and regulations. 2. You must act with the highest ethical standards and integrity. 3. You must act in the best interests of each client. 4. You must provide a high standard of service. 5. You must treat people fairly regardless of: a. Age b. Disability c. Gender Reassignment d. Marriage and Civil partnership e. Pregnancy and Maternity f. Race g. Religion and Belief h. Sex i. Sexual orientation |

| 12 | Financial Conduct Authority Principles | Medium | 1 Integrity 2 Skill, care and diligence 3 Management and control 4 Financial prudence 5 Market conduct 6 Customers’ interests 7 Communications with clients 8 Conflicts of interest 9 Customers: relationships of trust 10 Clients’ assets 11 Relations with regulators |

| 13 | Employee satisfaction index | Medium | The employee satisfaction index measures the extent to which employees report that they are happy working at Kuflink. |

Density of Offices

| Density of Offices | Formula | |

|---|---|---|

| 1 | 1 person to every 170 square feet | (5,435.77 square feet (total floor area) / 32 employees) |

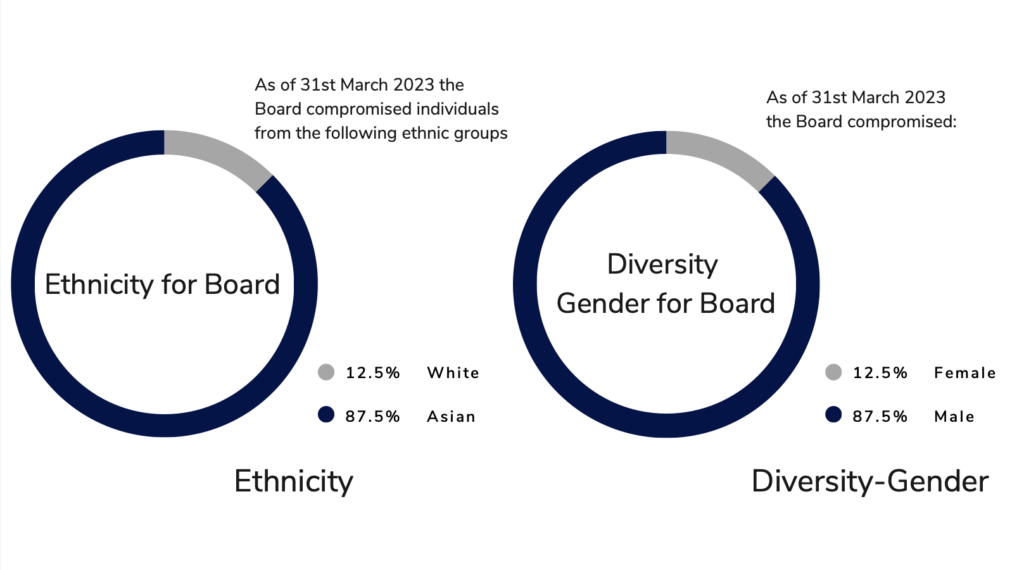

Board

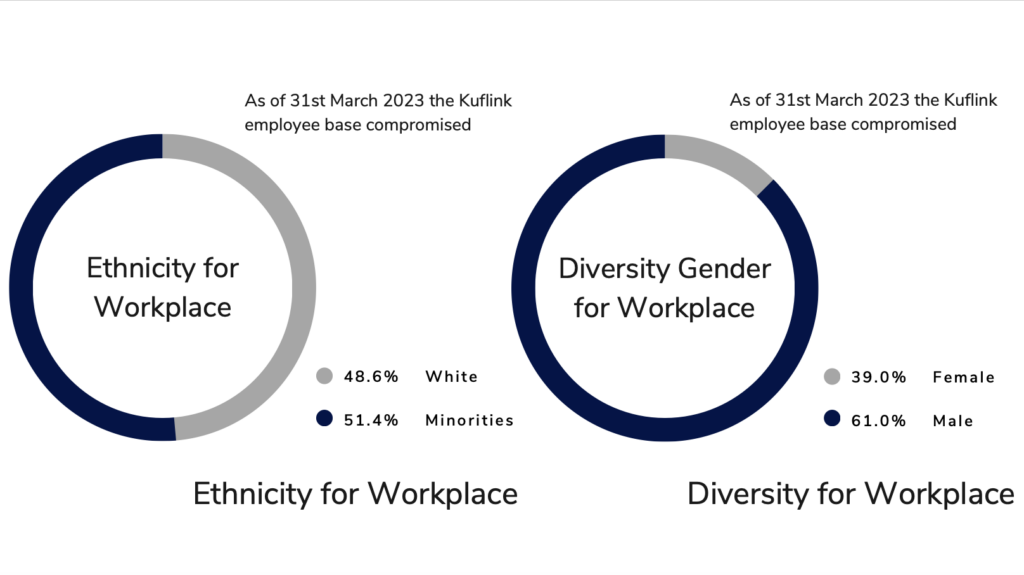

Workplace

Governance

Our governance indicator relates to areas of performance that support good governance practices and facilitate Kuflink Group being considered a responsible business. Governance for climate-related risk will be embedded into the Group’s existing governance structure and is complementary to the governance of the Group’s sustainability strategy.

1. Purpose 2. Strategy 3. Accountability informing Risk 4. Ethical behaviour

Governance - Committees

| ESG | ESG Impact | Ease of Implementat ion |

Internal / External |

Formation Date | Implemented | |

|---|---|---|---|---|---|---|

| 1 | Technology Committee | Low | Low | Internal | March 2018 | The Technology Committee focuses primarily on |

| 2 | Compliance / CASS committee | Low | Low | Internal | July 2019 | Regulatory reporting, maintaining risk |

| 3 | Remuneration committee | Low | Low | Internal | July 2019 | To ensure remuneration is aligned to the business |

| 4 | Nomination committee | Low | Low | Internal | July 2019 | To review the structure, size, and composition of |

| 5 | Audit & RISK committee | Low | Low | Internal | July 2019 | To review and monitor the effectiveness of the |

| 6 | Asset & Liability committee (ALCO) |

Low | Low | Internal | July 2019 | To Discuss management and monitoring of Debt |

| 7 | Executive committee (EXCO) | Low | Low | Internal | July 2019 | To discuss the overall business Objectives, Key |

| 8 | Wind Down planning committee | Low | Low | Internal | May 2020 | To monitor Kuflink Well-being metrics within the |

| 9 | Property Developments committee |

Low | Low | Internal | July 2021 | To monitor and discuss all development funding |

Governance - Independent Forums

| ESG | ESG Impact | Ease of Implementation |

Internal / External | Link | Awards / Ratings | |

|---|---|---|---|---|---|---|

| 1 | P2PIndependent forum | Low | Low | External | https://p2pindependentforum.com/ | N/A |

| 1 | P2P Market Data | Low | Low | External | https://p2pmarketdata.com/p2p-lending-funding-volume-uk/ | 2nd placed in UK |

| 1 | 4th Way | Low | Low | External | https://www.4thway.co.uk/ | 3 out of 3 Star Exceptional |

| 1 | Financial Thing | Low | Low | External | https://www.financialthing.com/ | 4 out of 5 Star |

| 1 | TrustPilot | Low | Medium | External | https://www.trustpilot.com/search?query=kuflink&search-button= | 4.8 out of 5 |

Governance - Consumer Surveys

| ESG | Date of Survey |

ESG Impact | Ease of Implementation |

Internal / Extenal | Scored 8 and above (out of 10) for rating overall experience with kuflink |

Scored happy on customer service |

Found products and services clear and easy to understand |

Found it easy to find answers |

Found platform easy to use | Found right information at the right time |

Confirmed using the platform brought a positive outcome. |

Feel they have a good understanding of P2P property loans |

Said we make risks and challenges associated with online investing clear and easy to understand |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Consumer Survey to All |

Jan 2022 | Low | Low | External | 84.37% | 84.85% | 96.87% | 96.87% | 93.75% | 84.37% | 100.00% | 93.75% | N/a |

| 2 | Consumer Survey to Everyday Investors Only |

Feb 2022 | Low | Low | External | 72.50% | 76.25% | 77.00% | 86.25% | 81.25% | 78.75% | 87.00% | 90.00% | 94.00% |

| 3 | Consumer Survey to All |

Jun 2022 | Low | Low | External | 84.45% | 97.90% | 91.75% | 89.69% | 85.93% | 86.01% | 95.74% | 96.39% | 96.89% |

Governance - Trustpilot

| Jul-22 | Sep-22 | Oct-22 | Nov-22 | Dec-22 | Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | FY22 | FY21 | FY20 | FY19 | FY18 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.7 | 4.8 | 4.8 | 4.8 | 4.8 | 4.8 | 4.7 | 4.7 | 4.7 | 4.6 | 4.5 | 4.4 | 4.5 | 4.5 | 4.4 | 4.7 | 4.6 | 4.6 | 4.6 | 4.5 |

Governance - Controls

| ESG | ESG Impact | Ease of Implementation | Internal / External |

Last Certification DATE | Link | |

|---|---|---|---|---|---|---|

| 1 | Cyber Essentials | High | Medium | External | December 2022 | Cyber Essentials Certificate |

| 2 | ISO 27001 (UKAS) Auditor | High | Medium | External | March 2022 | ISO27001 Certificate |

| 3 | External Independent Auditor | High | Medium | External | June 2022 | Macintyre Hudson MHA |

| 4 | Internal Independent Audit Team | High | Medium | External | February 2022 | Internal Control Framework incorporates: 1. COBIT 2. COSO |

| 5 | HMRC ISA Manager Approvals | Low | Medium | External | May 2017 | HMRC ISA Manager Approval Certificate |

| 6 | Insurances Professional Indemnity, Directors & Officers, Employers and Public, Cyber insurance |

Low | Low | External | May 2022 | Markel International Insurance Company Ltd |

| 7 | Operational Resilience | High | Medium | Internal | March 2022 | New requirements to strengthen operational resilience in the Payment Services sector (Open Banking - Kuflink One Ltd). We have undertaken this task across the Whole Group |

| 8 | B Corp Certified | High | High | External | April 2023 | Kuflink is proud to meet high standards of environmental and social performance (90.6 out of 100) |

Governance - Non-Executive Directors

| ESG | ESG Impact |

Ease of Implementation |

Internal / External | DATE | Directorship | Biography |

|

|---|---|---|---|---|---|---|---|

| 1 | Balbir Thind | Low | Medium | External | 19/05/2016 | Independent Non-Executive Chairman | Balbir is an entrepreneur and businessman who co-founded Michelin Star restaurant Hakkasan in London’s Mayfair, as well as Thai restaurant Basuba, both of which he has since sold. Balbir has |

| 2 | Sukhdev Dhillon | Low | Medium | External | 17/10/2018 | Independent Non-Executive Director | Sukhdev Dhillon has joined Kuflink following a 38-year career with RBS/NatWest Group. During this period, he was employed in some of the most prominent City offices of NatWest Bank, including a period in Credit Underwriting managing the credit risk for a number of major corporate clients. |

Governance - Group

| No | Group Company name | Model | Co No |

|---|---|---|---|

| 1 | Kuflink Group Plc | Group | 09084634 |

Governance - Authorised and Regulated by the Financial Conduct Authority

| Authorised and Regulated Subsidiaries Company name |

Companies House Number | Incorporation Date | Model | Internal / External | FCA Link | FCA Reg. No (FRN) | FCA Authorised Since | |

|---|---|---|---|---|---|---|---|---|

| 1 | Kuflink Ltd | 08460508 | 25/03/2013 | Online P2P platform | External | Kuflink Ltd on FCA Search Register | 724890 | 27/04/2017 |

| 2 | Kuflink Bridging Ltd | 07889226 | 21/12/2011 | Unregulated Bridging loans | External | Kuflink Bridging Ltd on FCA Search Register | 723495 | 14/10/2016 |

| 3 | Kuflink Home Loans Ltd | 07817421 | 20/10/2011 | Regulated mortgage loans | External | Kuflink Home Loans Ltd on FCA Search Register | 571773 | 06/06/2012 |

| 4 | Kuflink One Ltd | 12206864 | 13/09/2019 | Registered Account Information Service Provider (AISP) Open Banking |

External | Kuflink One Ltd on FCA Search Register | 922026 | 17/04/2020 |

Profit & Loss - Kuflink Group Plc

| £000's | 09/22 | 10/22 | 11/22 | 12/22 | 01/23 | 02/23 | 03/23 | 04/23 | 05/23 | 06/23 | 07/23 | 08/23 | 09/23 | 10/23 | YTD | FY23 | FY22 | FY21 | FY20 | FY19 | FY18 | FY17 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 77 | (9) | |||||||||||||||||||||||

| Interest Income | (1) | 965.7 | 1,004.5 | 1,037.9 | 1,074.6 | 1,113.2 | 928.9 | 1,089.6 | 1,144.3 | 1,401.1 | 1154.3 | 1250.6 | 1,290.6 | 1,132.1 | 17,411.3 | 13,096.9 | 8,255.4 | 6,141.2 | 5,850.0 | 3,990.4 | 2,829.7 | 3,787.7 | ||

| Total Net Income | (2) | 590.5 | 606.6 | 636.5 | 727.0 | 712.3 | 536.0 | 605.3 | 737.2 | 963.2 | 619.8 | 767.9 | 834.4 | 665.1 | 10,651.8 | 8,175.0 | 5,126.6 | 2,940.1 | 2,895.1 | 2,078.7 | 1,865.5 | 3,787.7 | ||

| Direct Costs | (3) | (48.3) | (44.2) | (50.3) | (50.4) | (52.3) | (39.3) | 47.5 | (55.0) | (305.5) | (66.0) | (53.6) | (175.7) | (93.4) | (1321.7) | (796.9) | (1,021.3) | 142.6 | 507.1 | (891.7) | (2,529.9) | (1,529.4) | ||

| Gross Profit | (4) | 542.2 | 562.4 | 586.2 | 676.7 | 660.0 | 496.7 | 557.7 | 682.2 | 657.6 | 553.8 | 714.3 | 658.7 | 571.7 | 9330 | 7,378.2 | 4,105.3 | 3,082.7 | 3,402.1 | 1,187.0 | (664.4) | 2,258.3 | ||

| Other Costs | (5) | (351.6) | (347.5) | (413.3) | (392.1) | (367.8) | (374.5) | 447.2 | (438.9) | (378.3) | (486.2) | (421.0) | (443.2) | (452.0) | (6,378.8) | (4,679.6) | (3,376.1) | (2,853.0) | (3,624.0) | (3,906.2) | (3,073.3) | (2,140.1) | ||

| Net Profit before Tax | (6) | 190.6 | 214.9 | 172.8 | 284.6 | 292.2 | 122.2 | 110.5 | 243.3 | 279.4 | 67.5 | 293.3 | 215.5 | 119.7 | 2,951.3 | 2,698.5 | 729.1 | 229.7 | (221.9) | (2,719.2) | (3,737.7) | 118.1 | ||

| Taxation | (7) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1.0 | 0.0 | 1.0 | 0.0 | 0.0 | 232.9 | 103.3 | 0.0 | 341.4 | (82.1) | ||

| Net Profit after Tax | (8) | 190.6 | 214.9 | 172.8 | 284.6 | 292.2 | 122.2 | 110.5 | 243.3 | 279.4 | 67.5 | 293.3 | 216.5 | 119.7 | 2,942.3 | 2,698.5 | 729.1 | 462.6 | (118.6) | (2,719.2) | (3,396.4) | 36.0 | ||

| Compound Annual Growth Rate of Interest Income (CAGR) | 23% | 22% | 13% | 16% | 3% | -25% | ||||||||||||||||||

| Funding of Balance Sheet | 4,603 |

Notes

(1) Interest earned from loan book. (Reported net in FY17).

(2) Total Net Income is all interest and fees earnt on loans for the period less interest paid to investors.

(3) Direct Costs includes all other loan set up costs and cashbacks due to investors. Direct Costs also includes movements in bad debt provision, hence shown as income in FY21 & FY20 as some debts previously written off in FY18 were recovered.

(4) Gross Profit reports the income remaining on loan interest and fees after deducting costs directly related to the loans.

(5) Other Costs relate to all the other costs incurred in running the business (including salaries, marketing, IT costs and depreciation of assets)

(6) Profit made by Kuflink before Tax

(7) Corporation Tax paid, note this is paid yearly, company has tax credits on historical losses, not yet calculated for FY22

(8) Remaining profit after Corporation Tax

(9) Forecast for FY23 based on latest projection

FY = Financial years to 30th June. (FY17 was for 18 months)

Balance Sheet - Kuflink Group Plc

| £000's | 10/22 | 11/22 | 12/22 | 01/23 | 02/23 | 03/23 | 04/23 | 05/23 | 06/23 | 07/23 | 08/23 | 09/23 | 10/23 | FY23 | FY22 | FY21 | FY20 | FY19 | FY18 | FY17 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (8) | ||||||||||||||||||||||

| Net Loan Book | (1) | 103,068 | 103,789 | 102,642 | 105,064 | 105,361 | 108,864 | 108,574 | 107,274 | 109,192 | 109,667 | 103,068 | 101,785 | 101,785 | 175,000 | 85,962 | 54,165 | 36,405 | 29,646 | 16,598 | 10,508 | |

| Cash at Bank | (2) | 1,323 | 1,680 | 1,470 | 1,584 | 2,530 | 1,599 | 3,041 | 3,192 | 2,978 | 2,010 | 1,323 | 4,146 | 4,146 | 3,061 | 2,004 | 1,683 | 562 | 1,228 | 876 | 1,058 | |

| Other Assets | (3) | 2,335 | 2,261 | 2,200 | 2,170 | 2,153 | 2,200 | 2,203 | 2,258 | 2,197 | 2,471 | 2,335 | 2,726 | 2,726 | 2,148 | 2,229 | 2,257 | 1,961 | 2,305 | 1,713 | 1,241 | |

| Total Assets | 106,726 | 107,731 | 106,313 | 108,818 | 110,044 | 112,663 | 113,818 | 112,724 | 114,367 | 114,148 | 106,726 | 108,657 | 108,657 | 169,953 | 90,195 | 58,105 | 38,927 | 33,179 | 19,188 | 12,807 | ||

| Investors | (4) | (96,913) | (97,468) | (96,474) | (98,356) | (99,501) | (101,589) | (102,374) | (100,701) | (102,481) | (101,718) | (96,913) | (94,489) | (94,489) | (152,507) | (81,251) | (52,339) | (35,027) | (32,833) | (17,486) | (8,362) | |

| Other Creditors | (5) | (5,210) | (5,487) | (4,808) | (5,139) | (5,098) | (5,518) | (5,585) | (5,885) | (5,931) | (6,182) | (5,210) | (7,591) | (7,591) | (10,626) | (5,032) | (2,611) | (1,574) | (1,276) | (843) | (402) | |

| Total Liabilities | (102,123) | (102,955) | (101,282) | (103,495) | (104,599) | (107,107) | (107,959) | (106,586) | (108,413) | (107,900) | (102,123) | (102,079) | (102,079) | (163,133) | (86,283) | (54,950) | (36,601) | (34,109) | (18,329) | (8,764) | ||

| Net Balance Sheet | 4,603 | 4,776 | 5,031 | 5,323 | 5,445 | 5,556 | 5,859 | 6,138 | 5,955 | 6,248 | 4,603 | 6,578 | 6,578 | 6,821 | 3,911 | 3,155 | 2,326 | (930) | 859 | 4,043 | ||

| Share Capital | (6) | 9,343 | 9,344 | 9,344 | 9,343 |

Notes

(1) Loan Book with future retained interest deducted and adjusted for any impairments.

(2) Bank Balance.

(3) Other Assets held including fixed assets, payments made in advance and value of P2P platform and after IT applications built in-house.

(4) Platform and KBL investor balances.

(5) All others owed including interest accrued but not yet paid.

(6) Shares issued

(7) Cumulative total of all profit and losses since incorporation

(8) Forecast for FY23 based on latest projection

Taxes Collected and Paid - Kuflink Group plc

| £000's | 10/22 | 11/22 | 12/22 | 01/23 | 02/23 | 03/23 | 04/23 | 05/23 | 06/23 | 07/23 | 08/23 | 09/23 | 10/23 | YTD | FY22 | FY21 | FY20 | FY19 | FY18 | FY17 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporation Tax | (1) | (232.9) | (103.3) | 0.0 | (341.4) | 82.1 | ||||||||||||||||

| PAYE Tax | (2) | 57.6 | 78.3 | 65.9 | 56.2 | 56.9 | 64.4 | 64.4 | 64.0 | 63.0 | 66.8 | 70.2 | 66.2 | 69.4 | 918.6 | 570.3 | 525.5 | 636.3 | 502.2 | 436.8 | 378.1 | |

| VAT | (3) | 13.6 | 18.3 | 19.7 | 26.7 | 76.8 | 82.7 | 204.1 | ||||||||||||||

| Total | 57.6 | 78.3 | 79.5 | 56.2 | 56.9 | 82.8 | 64.4 | 64.0 | 87.7 | 66.8 | 70.2 | 92.7 | 69.4 | 889 | 797.1 | 496.8 | 533.0 | 502.2 | 95.5 | 460.2 |